Enterprise media buying sits at the nexus of data, creativity, and precision. That’s especially true for global brands managing multinational campaigns across dozens of markets.

Brands continue to invest in ads through various media types, even as economic uncertainties made headlines in 2025.

According to the Wall Street Journal, advertising revenue grew 8.8% in 2025 to $1.14 trillion, with most dollars going toward digital.

For enterprise buyers, this means mastering a mix of platforms such as Google Ads and Meta for search and social media, retail display tools like CitrusAd’s auction‑based placements within e‑commerce environments, and programmatic stacks.

It goes without saying that without a solid strategy, ad dollars can easily go to waste. Well-defined media buying strategies ensure performance optimization, which, in turn, improves ROI across channels.

Use this as a guide to create a media buying strategy for your global brand (or work with the experts like Fieldtrip for fully optimized, mission-driven media planning and buying).

Let’s dive in.

Media buying is the strategic process of purchasing ad placements across relevant channels, from digital platforms, like search engines, social media, and streaming video, to traditional outlets such as TV, radio, and out‑of‑home.

Media buying turns a campaign’s strategy into action by:

In practice, our media buyers at Fieldtrip (like many others) leverage programmatic platforms and real‑time bidding (RTB) on demand‑side platforms (DSPs). The goal is to automate purchases and target individuals based on:

For enterprise marketing teams at global brands, media buying isn’t simply about purchasing ads on a few platforms. In reality, agencies like ours are typically orchestrating complex, multinational campaigns that reflect diverse cultural contexts, regulatory frameworks, and audience behaviors.

That, of course, brings unique challenges and nuances.

Let’s talk about it.

First, global enterprises face far greater complexity. Good media buyers know how to balance placements across multiple channels, each with unique rates, audience patterns, and regulatory demands.

We do this kind of multi‑channel orchestration, too.

For that, we use advanced tools for real‑time analytics and campaign performance optimization, unlike smaller efforts that might focus on one or two channels.

But more importantly, global buying demands localized precision.

We always build campaigns that resonate with local cultures, languages, and consumer behavior, which means adapting ad creative and message across markets rather than running a one‑size‑fits‑all strategy.

Also, some channels may be more productive and profitable in specific geographies.

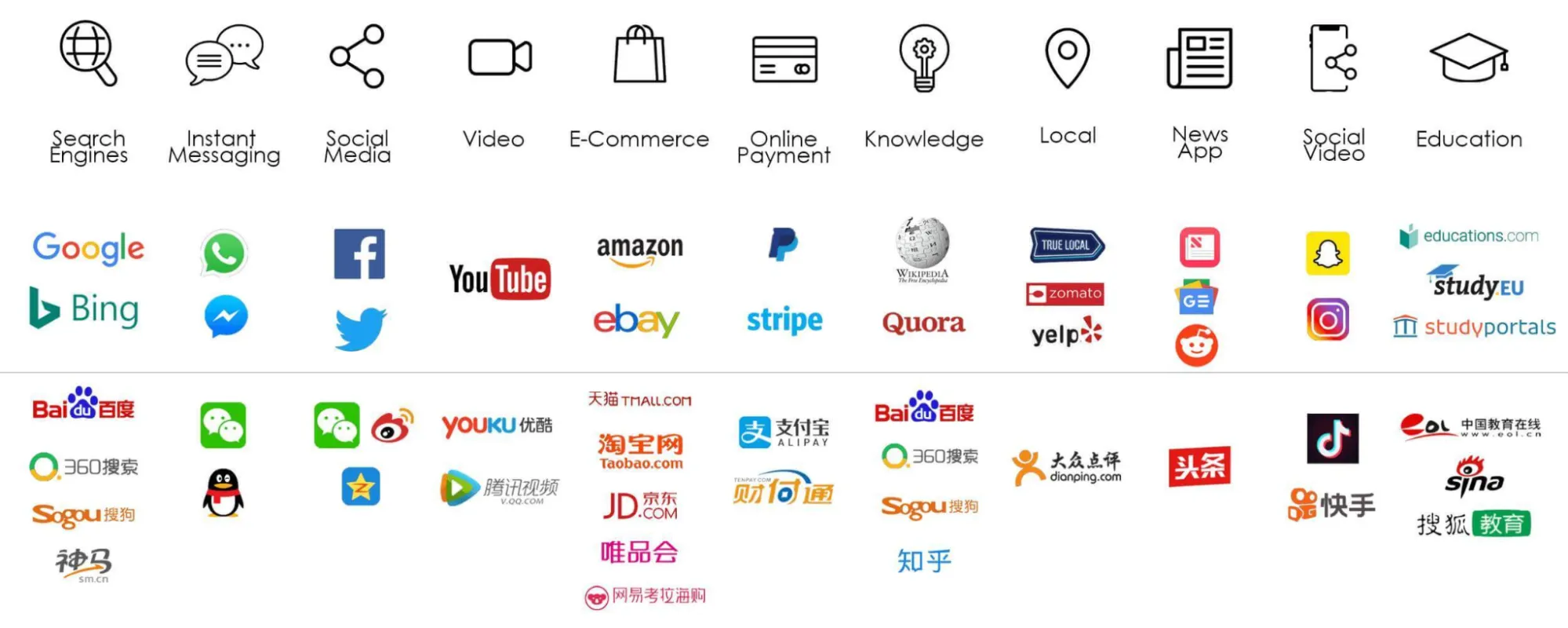

The best example we can think of is China, a country with its own ecosystem of search, email, and social platforms. For truly global brands with a presence in China, our media buying efforts include a separate platform-specific strategy for the Chinese market.

Compliance and governance add another layer of complexity. Different countries enforce varied advertising regulations (e.g., data privacy laws or restrictions on certain ad placements), forcing enterprise buyers to deal with legal and industry constraints that local buyers rarely encounter.

For instance, our clients in the European Union must comply with the General Data Privacy Regulation (GDPR). That requires companies to get consent and protect consumer data. And failure to do so can result in penalties.

Some regulations can even impact the creatives you use in ads.

In Norway, ads must be labeled if the faces or bodies displayed in them have been altered or retouched (to keep beauty standards more realistic).

You can imagine the complex web of rules and regulations our media buyers must take into account when strategizing.

Every company needs a media buying strategy, especially at the enterprise level. That’s because of the sheer variety of media and the budgets required to buy ad space. Doing all of that haphazardly without insight, data, and strategy is a recipe for failure.

Here’s why media buying strategy is so crucial:

At the heart of any successful enterprise campaign is the ability to reach the right people (not just many people).

That’s why all our media buying strategies use audience research and segmentation to tailor placements to specific demographics and behavior patterns. At Fieldtrip, we make sure ads resonate with those most likely to convert (and so should you if you’re creating this plan now).

Consider these statistics:

We advise you to use tools like Google Analytics, Facebook Ads Manager, and DSPs to define precise segments and monitor performance in real time.

A well‑designed strategy ensures that ad spend is tied directly to clearly defined objectives. That could be something as simple as more sales or more long-term, like capturing market share.

A media buying strategy helps media buyers allocate money to channels that are most likely to be impactful. Smart media planners and buyers focus on performance metrics such as Cost Per Action (CPA) and Return on Ad Spend (ROAS).

For enterprise brands, this means deploying complex analytics to track outcomes across search engines, social media, display advertising, and video content platforms.

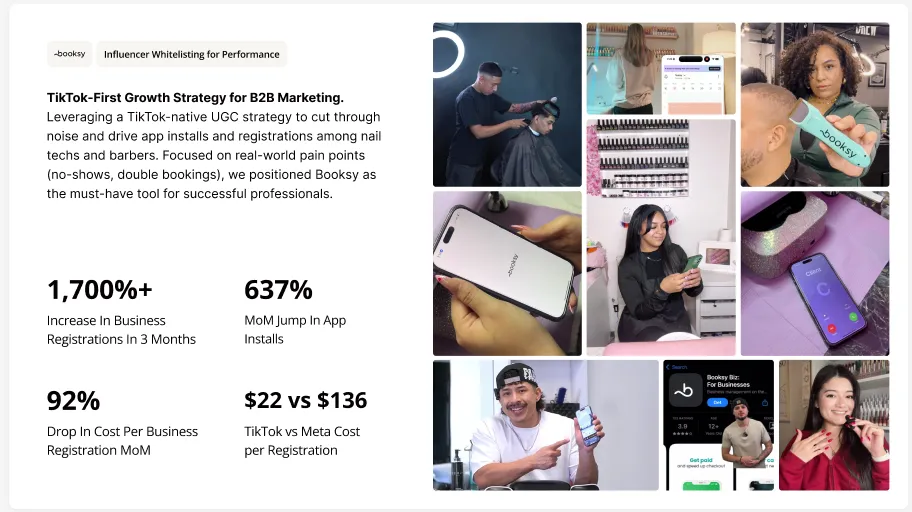

At Fieldtrip, each media buying campaign is highly goal-driven, with KPIs that actually measure brand growth (as defined by the brand itself). For instance, for Booksy, we chose TikTok over Meta because of its extensive small-business-oriented audience, which helped the brand increase business signups while keeping costs down (much lower than Meta).

This is an important one. Enterprise brands must protect their message and reputation across all ad placement environments. A strategic media buy ensures ads appear in the right contexts, so:

We advise all our clients to take this point seriously because a recent report from Adalytics found that ad tech platforms weren’t doing enough to prevent ads from being displayed on shady websites. This puts brand safety in jeopardy and places the burden on brands to maintain checks.

Also, strategic control extends beyond placements.

You’ll want to focus on:

In enterprise settings, we advise you to structure media buying around frameworks that ensure consistency, precision, and performance. And all that should be across all markets and channels.

Below, we explore the essential frameworks every global brand’s media buying team should use to drive measurable impact.

And yes, we use them too:

Multi‑channel planning is the backbone of effective enterprise media buying. Simply put, it’s about sequencing and aligning ads across search engines, social media, display, video, connected TV, and offline formats.

That way, your audience finds your brand where they’re most receptive.

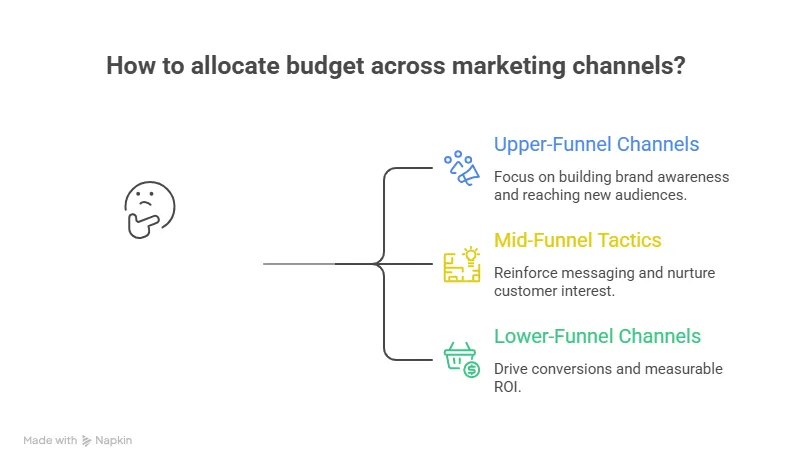

This is where Fieldtrip relies heavily on role-based channel allocation and upper-mid-and-lower funnel media mix.

Role‑based channel allocation means assigning budget and resources based on each channel’s role in the customer journey, whether it drives awareness, consideration, or conversions.

One of the biggest challenges we’ve seen for enterprises is frequency and overlap.

How do you make sure that people see your brand enough times to remember it without oversaturating them and wasting budget?

Well, we use frequency capping tools within DSPs and platforms like Meta or Google Ads.

These help you control how many times your ads appear to the same individual, which prevents audience fatigue and lowers acquisition costs.

But with enterprise-level media buying, we also have to plan for cross-channel overlap.

This can be addressed with consolidated analytics in a unified data platform like Adobe Analytics or GA4 that lets you track campaigns across different channels.

Audience strategy at enterprise scale covers more than basic demographics. It looks at behavioral signals, affinities, and contextual indicators so ads resonate deeply with each segment.

Sophisticated segmentation draws on first‑party data (CRM, CDPs, etc.), second‑party partnerships, and privacy‑safe contextual insights to build rich buyer personas tailored to global campaigns.

Then, platforms like DSPs use these profiles to bid on impressions in real time. That helps optimize delivery to relevant audiences and reduce waste.

For example, a retail brand might activate first‑party data from its CRM system to identify high‑value customers and then use programmatic tools to retarget these individuals across display and video channels.

We recommend this type of layered approach so your enterprise campaigns are personalized well. In turn, this improves both reach and engagement.

Large brands typically choose between centralized and decentralized media buying models based on business model and structure.

A good example of decentralized and localized media buying would be Coca-Cola running Ramadan TV ads and digital campaigns in the Middle Eastern markets.

Many enterprises adopt a hybrid model, though. This is a central strategy with localized execution to balance global vision with regional relevance.

We advise you to make the right choice according to your business goals because whatever you choose influences:

Remember: Regardless of model, align around shared KPIs and use centralized dashboards. That way, your teams are always working toward the same business goals.

Programmatic buying automates ad purchases using real‑time bidding (RTB) and algorithmic optimization across digital inventory. And it has become the dominant method for large‑scale media buys, so we, of course, use it too.

The numbers tell the truth. The programmatic advertising market is projected to reach $4,397 billion by 2032.

Of course, DSPs play a key role here.

They enable enterprise teams to:

All this is done across search, display, social, and video environments.

Side note: For enterprises, especially those looking to implement a more centralized model of media buying, we always recommend programmatic.

That’s because it offers a mix of different channels, real-time placements, and performance analytics to adjust strategy on the fly.

Pro tip: Programmatic buying is best suited for enterprises seeking a diverse mix of media, including display, social, connected TV, and digital out-of-home (OOH) ads. For more niche brands that focus on fewer platforms, native ad tools should suffice.

Technology powers enterprise media buying and realizes those strategic goals. High-impact ad campaigns across channels call for a sophisticated MarTech/AdTech ecosystem that integrates tools for data, targeting, activation, measurement, and optimization.

A modern enterprise ad technology stack blends MarTech (platforms that manage customer data and orchestration) with AdTech (tools that buy, deliver, and measure paid media). And now with Artificial Intelligence (AI) in the mix, media buying is getting even more streamlined.

The typical enterprise stack we use includes:

Media buying, creative execution, and measurement (basically all facets of advertising) are getting a taste of AI and AI-enabled automation.

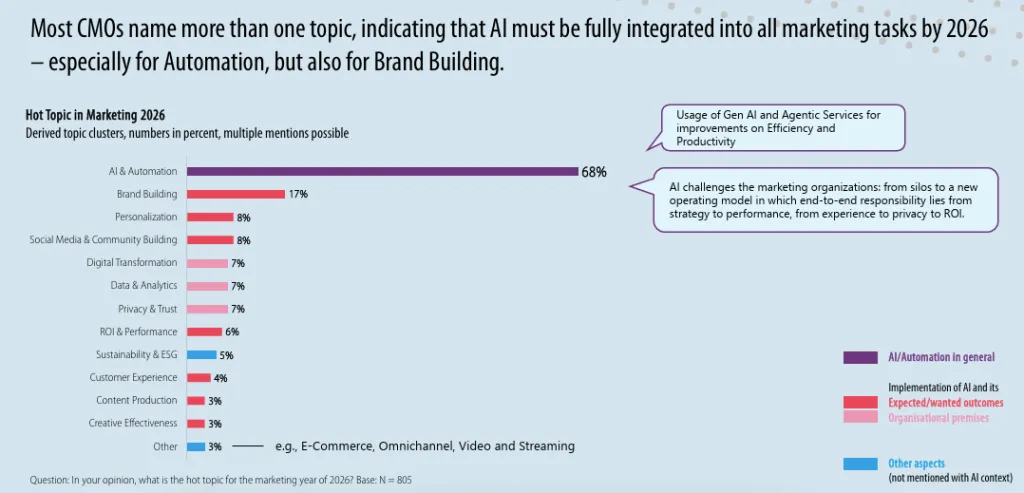

In fact, it’s what’s on the minds of all Chief Marketing Officers (CMOs) we know.

Current data shows that AI & automation is genuinely a hot topic for 68% of CMOs. And that goes to show just how consequential these technologies can be.

Besides, 88% of marketers are already using AI in their day-to-day.

However, in our opinion, the biggest AI-related thing in media buying will be autonomous agentic systems.

These AI agents do more than follow preset rules; they use predictive modeling to anticipate consumer intent and reallocate budgets in real-time across search, social, and streaming channels (CTV) to optimize for deep-funnel business outcomes.

This is also shifting the role of the traditional media buyer.

Human expertise is now focused on defining high-level guardrails to ensure brand safety and feeding the AI "clean" first-party data.

While AI is involved in high-frequency execution and dynamic creative optimization, the strategic value lies in interpreting the "why" behind the data.

We use this kind of hybrid model, too, because it allows brands to achieve hyper-personalization at a global scale while maintaining the creative authenticity and legal compliance where automated systems still struggle.

At Fieldtrip, we believe that measurement is the backbone of effective media buying at enterprise scale.

Media Mix Modeling (MMM) analyzes historical spend and sales data to determine how different channels contribute to business outcomes, while multi‑touch attribution (MTA) assigns credit to individual touchpoints.

Pro tip: Advanced platforms combine MMM, geo lift studies, and incrementality testing to help advertisers understand both short‑ and long‑term effects of spend, especially as third‑party cookies phase out.

We, of course, use real‑time dashboards to visualize performance trends and inform reallocations of media dollars.

We encourage you to use these tools to align your campaign decisions with broader business goals and prove ROI across global markets.

Managing enterprise‑level media operations requires a structured approach. Below, we explain how we help global brands to orchestrate these aspects effectively.

Strong media governance gives you the foundation for consistency, accountability, and performance across enterprise campaigns.

It defines roles, sets KPIs, and enforces compliance with internal and external standards. On a granular level, it guides how teams make decisions about channels, ad placements, and spend.

Our governance frameworks (like all other good frameworks) typically include:

Pro tip: Create cross‑functional committees that include marketing, legal, finance, and analytics teams to inform a consistent brand identity and guidelines (essentially covering brand values, language, and look), which, in turn, will help media buyers.

We know that working with external media buying agencies is a core part of enterprise operations for many brands. That’s because agencies bring strategic insights, operational capacity, and negotiation expertise that augment in‑house teams.

Effective collaboration models include:

While some clients use Fieldtrip’s expertise for media buying across the board, others enlist our specialty services like creator marketing (via inBeat) to source relevant creators, produce content, and use it as ad assets for paid social.

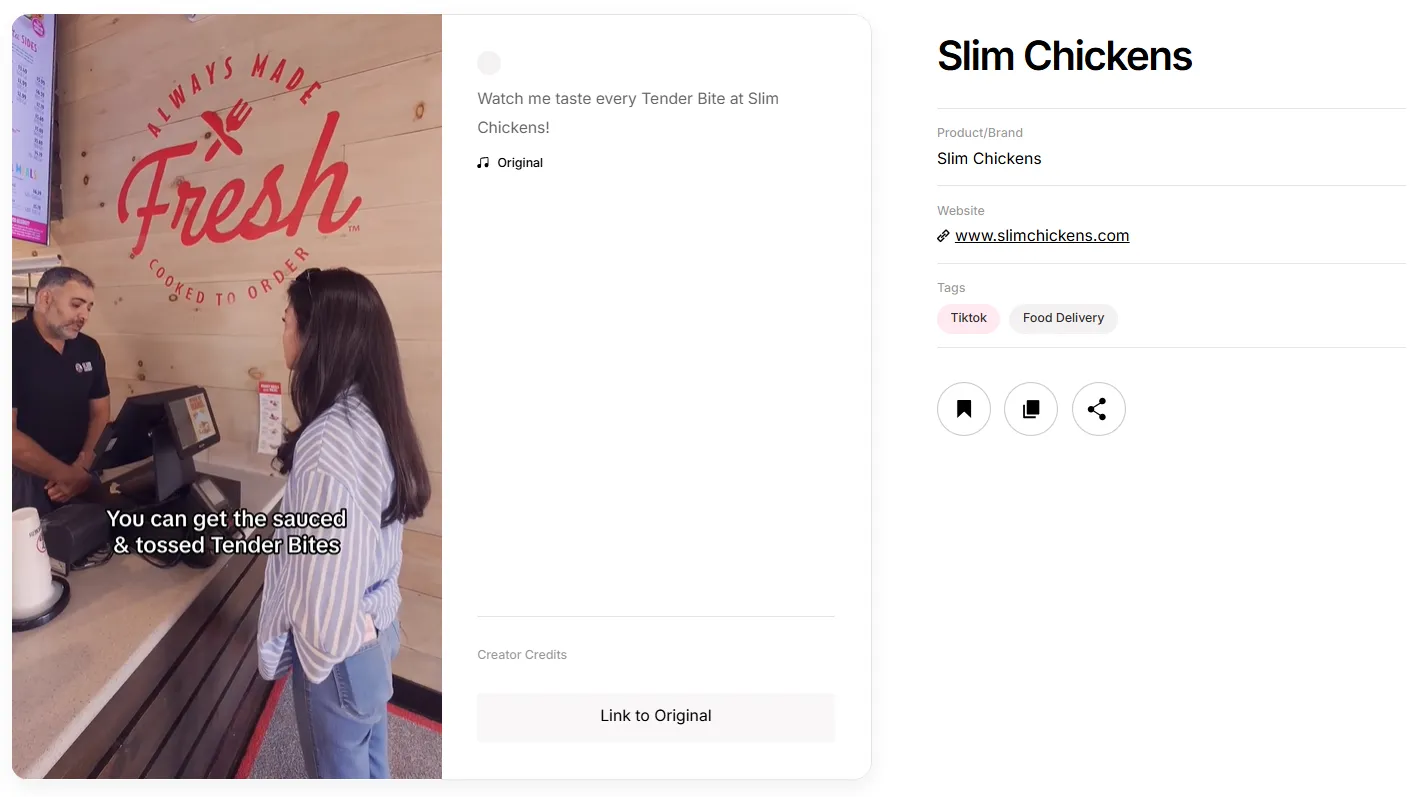

Here’s an example of a creator-focused campaign on TikTok for our client Slim Chickens, an American fast food chain going global with locations in Europe, the Middle East, and Southeast Asia.

Enterprise media buying is a massive operation with millions spent across channels. That brings negotiation leverage, which shouldn’t be taken for granted.

Media teams must negotiate not only with agencies but also with platform partners and vendors to secure favorable rates, added value, and preferential placements. Smart negotiation impacts both cost efficiency and outcome performance.

Here are some tips from our expert media buyers:

Enterprise media buying is a big undertaking, given the wide range of channels, huge budgets, and growing competition for ad space.

The bottom line is simple: without a solid strategy and dedicated minds behind the whole thing, you risk losing money on media that doesn’t do much for the business.

To win in the increasingly challenging paid media space, you need a reliable partner like Fieldtrip with the expertise, insight, and tools to optimize every last dollar.

We cover the most well-performing channels like search, paid social, and CTV, for global brands with interconnected but small, nimble teams for strategy, execution, and measurement.

Whether you want a singular agency to collaborate on all media buying or a partner that extends your capacity for specific channels like influencer, social, or search, Fieldtrip is the answer.

Schedule a meeting and discover more about our media magic!

Media planning is the strategic process of deciding where, when, and to whom your ads should run to reach ideal audience segments and meet business goals. It involves audience research, defining budgets, selecting channels (e.g., search, social media, display, video), and establishing KPIs before execution.

Media buying is the tactical execution of that plan: the actual purchase of ad placements across chosen platforms, optimizing rates, negotiating inventory, and monitoring delivery.

The classic 5 Ms framework outlines the essential components of any comprehensive media strategy:

This framework ensures that media buying decisions are tied back to clear business objectives, cost efficiency, and measurable performance.

Yes. Unified strategies help global brands maintain brand consistency, streamline performance measurement, and maximize the value of every ad dollar. A cohesive approach allows marketing teams to apply global insights to audience segmentation, optimize campaigns in real time, and reduce redundant spend across markets.

Large brands may want to work with agencies because these partners bring specialization, scale, and structural support that internal teams alone may lack. For example, they can have deep knowledge of media buying strategy and execution across search, social, programmatic, and video channels. Also, they have access to advanced tools and analytics stacks that improve targeting and attribution.

Fieldtrip, a full‑service media and marketing agency, manages a broad suite of paid media channels across the marketing spectrum. These include: